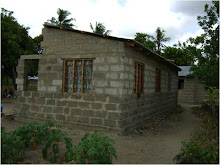

The owner of this house received a loan this week that includes a door.

ACTIVITIES DURING THE WEEK

It is a disbursement week, so the early part of the week was used in preparing loan agreements and calling in clients approved last week to pay their insurance and security deposits and then sign their agreements. Because Wednesday was a national holiday (in remembrance of Julius Nyerere, the first president of Tanzania), cheque processing took place on Thursday and loans were disbursed on Friday morning. Verification and client assessments were also taking place throughout the week.

After our first quarter of operating the MAKAZI BORA pilot, reports were prepared for Habitat for Humanity International. Much work went into reconciliation of manual loan tracking records at Mbagala Branch and the computerized accounting program at the head office. The reconciliations were successful, but we look forward to having a computerized loan tracking system in the near future to facilitate the work of reconciliation as well as prompt follow-up of clients.

UPDATED STATISTICS:

As of 16th October 2009, we have 116 active clients at the Mbagala Branch. Here are some summary statistics:

1. Average Loan Amount: 1,101,987 shillings (+/- $830)

2. Average Loan Period: 16 months

3. Portfolio at Risk: 0%*

4. Repayment Rate (Current) at at 30th September: 98.8%*

5. Percentage of Women Clients: 55%*

6. Average Household Per Capita Income in US Dollar Equivalent: $2.24*

7. Break Down of Loan Uses:

Auxiliary Structures: 9%

Completions: 24%

Fininishing: 53%

Repairs: 12%

Extensions: 2%

COMMENTS ON STATISTICS:

Loan Period: Loan periods can be for 6 months, 12 months, 18 months or 24 months as per the clients choice after viewing the various pricing options. The most common loan period selected is 12 months.

Portfolio at Risk: The current portfolio at risk (30 days) is truly 0%, but it is still too much early to be taken as an indicator that can reliably predict future performance.

Repayment Rate Current: Some clients have missed their payments, but paid promptly when followed up, (sometimes through their guarantors or spouses). Only one client was behind in payment at the close of September. This was due to a conflict over his verification status. We considered his loan as diverted and he considered it as verified and paid at the verified rate. This resulted in an incomplete payment against his repayment schedule that uses the diverted rate. It is a problem in which we are partially (or maybe even largely) to blame and we are taking steps to avoid it in the future.

Percentage of Women Clients: This has remained remarkably consistent within a few percentage points. We have not specifically targeted women with the product, but women who hear about it seem to come back bringing their friends. This indicator is for women clients, which is not necessaily women headed households. Some are married, but presented themselves as the clients.

Per Capita Household Income in Dollar Equivalent: These figures are still experimental and should be considered very rough estimates rather than accurate calculations. The degree of reliabiilty is still very uncertain.

Loan Uses: Finishing (new work done on an occupied house) continues to be the most common loan use. Extension is the least common, but there have been problems in classifying extensions. At times extensions have been classified as finishing or completion based on the level of work already done to the extension at the time of assessment. Given our loan use criteria as they have developed, extension may no longer be a relevant loan use category. If we find the extension walls there and the extension is not occupied, it is often being counted as completion. If the extension is an unfinished part of the house that is somehow occupied, it is counted as finishing.

.jpg)

No comments:

Post a Comment