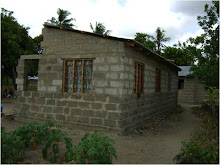

Verification of some of the loans disbursed that were in August took place during the week. One client who is had taken a loan of 370,000 shillings (+/- $275) to do work on a toilet and put doors and windows on a house that is not yet occupied. He completed the work, having bought used doors and windows that he could afford. The client worked within his means to achieve his objective of closing the structure with a MAKAZI BORA loan. During the same verification exercises, another client had put in doors and windows valued up to 250,000 shillings each. The same loan product serves people of different income levels in their housing processes.

The credit committee met on Friday and 25 loans were approved for disbursement in week 13. It was decided that due to the intensity of the process of approving and disbursing loans, they would be disbursed twice per month instead of on a weekly basis.

Also during the week, we worked on some analysis of the first 55 loans disbursed (not inclusive of the 25 approved on Friday 11th September). It is still very early in the program, so we do not expect the data to necessarily be conclusive. Furthermore, we are still working on improving the accuracy of income assessments and are under the belief that many of the early assessments had overstated business income. Here are some of our first findings, to be upgraded in the future as we continue to disburse home improvement loans and collect data on our clients, the loans and our performance.

(click on graph for enlarged version)

The majority of the first 55 clients (57%) were women. Some, but not all, were women-headed households. The households of our female clients had slightly higher incomes than the households of our male clients. This is not necessarily representative of anything, but it is simply a surprising observation within the set of our first clients.

Household income is tracked as per capita household income per day in dollar equivalent using 5 categories that range from $1.00 and less to over $5.00. Our target is to have less than 20% of clients in the Over $5.00 per day category. Within the first 55 loans, we had 40% of clients in this category, with diminshing amounts with each category as income levels decreased. Part of the problem may be overstated incomes, but a significant number of clients appear to be relatively more wealthy and established than our general target. Many of these are coming for loans to connect to electricity. We will continue to monitor these trends. Next year we will be revising the product and may need to make adjustments to ensure that we are serving a low income target group.

So far the majority of loans have been finishing. Finishing is new work undertaken on a house that is already occupied. The second most common loan use has been completion: New work on a house that is not yet occupied. Completion loans tend to be for roofing, doors and windows, while finishing takes on a variety of uses such as ceilings, floors, plastering walls, connecting to electricity, etc.

Clients are able to choose their own loan periods as loan as the proposed loan amount falls within affordability limits. Because the interest rate is flat, a longer loan period means that the client pays more interest over the cost of the loan. Shorter loans result in less total interest paid, but because the principal is divided among fewer months, the monthly installments are usually higher. Clients study tables to see the costs of various loan amounts at different loan periods. Each of the four possible loan periods (6 months, 12 months, 18 months or 24 months) was chosen by various clients, with 12 months being the most common.

It is too early to tell if these trends will be representative of MAKAZI BORA's future. We hope to present more analysis on a regular basis in the future.

.jpg)