On 23rd June 2009 Habitat for Humanity Tanzania registered Shamte Wambanguru of Tuangoma as the 1st client in its MAKAZI BORA housing microfinance program. Today, about 20 months later, MAKAZI BORA has registered its 1,000th Client. Ally Mbingwe from the Chamazi Ward of Temeke Municipality Dar es Salaam registered and was given a MAKAZI BORA T-Shirt to commemorate the occasion of our 1,000th Client.

MAKAZI BORA has gone through some changes and struggles since it opened its doors on 22nd June 2009. Product features were modified in July 2010 and there are constant minor revisions to our processes to improve customer service and efficiency. Our performance went into slight decline after about 5 months of operation, but has shown remarkable improvement in terms disbursements repayment and overall efficiency since July 2010.

As of the end of February 2011, MAKAZI BORA had a total of 487 active clients with a loan portfolio valued at 292,057,000 Tanzania Shillings. 646 loans have been disbursed since MAKAZI BORA started. 62 of these were to return clients who completed their first loans. (Clients who diverted their first loans to non-housing purposes are not eligible for second loans.)

The average loan amount at disbursement has decreased from slightly over 1,000,000 shillings to about 748,000 shillings. We see this as a positive trend in terms of our ability to serve households with lower incomes. The loan diversion rate has also declined nearly 15% to 10%, The loan diversion rate is less than 3 % for loans disbursed since July 2010 when we implemented a more detailed technical review of client home improvement project budgets and began more rigorously ensuring that there is evidence that proposed projects are “active.”

Portfolio at risk (30 days) was a disappointing 8.1% as at February 28 2011. The only minor consolation is that all of those clients having loans over thirty days in arrears had their loans disbursed prior to the change of product features and procedures in July 2010. The vast majority of those in arrears are from our first 6 months of lending. A dozen of the most challenging cases of default in payment have been in court for many months without a positive resolution. Getting a prompt resolution through justice system is a challenge, but the cases that have gone to court are admittedly bad loans or badly managed loans.

By the end of February 2011 we had 100% turnover in our original credit officers. Whereas some credit officers have had portfolios with upwards of 20% PAR, other credit officers with the same case load in the same geographic area have managed to maintain 0% PAR. This seems to indicate that the problem is not in the product’s suitability, but that human resources are a key factor in portfolio performance.

We continue to struggle with a manual loan tracking system, as final preparations are being made to implement a loan tracking software. The manual system is unreliable and prone to error, consuming significant time and resources that could be allocated to credit management. Nothing annoys a client more than being followed-up as a delinquent client when he or she has actually paid. Likewise, delays in knowing that a client is delinquent in payment results in a host of subsequent challenges and problems. Daily portfolio reports throughout the month have a margin of error of up to 3% on PAR and final monthly reports can take more than week to reconcile to financial and bank statements. This is currently THE major constraint to advancing the MAKAZI BORA program.

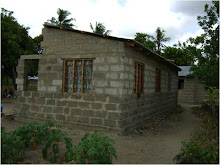

Despite some constraints (inclusive of daily power cuts and weak banking systems), we continue to learn and improve as we pilot the MAKAZI BORA housing microfinance program. The demand is high, even without having undertaken any serious promotion initiatives. (We have passed out brochures in the area, but most clients learn about us through word of mouth.) We are convinced that once a few internal issues are improved, we will be ready to access capital sufficient to scale up our program and assist thousands of households to improve their living conditions through access to affordable housing finance.

.jpg)

.jpg)